Accounting Updates

Updates from ISSB

Over the last few years, there has been an increase in emphasis towards the disclosure of non-financial information and related risks and opportunities by the companies, alongside the traditional financial information and disclosures. In order to facilitate the creation of a global baseline for investor-focused sustainability and non-financial reporting, in March 2022, the International Sustainability Standards Board (ISSB) had issued the Exposure Drafts (EDs) of its first two IFRS Sustainability Disclosure Standards – IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2, Climate-related Disclosures .

Based on the feedback received from different stakeholders, on 26 June 2023, ISSB released the final standards. The standards are designed to meet the needs of all companies, and provide a clear idea of what companies need to report on, in order to meet the needs of global capital markets. In this regard, some important aspects which need to be considered are:

- Applicability: The standards are effective from 1 January 2024, but it would be for individual jurisdictions to decide whether and when to adopt them. Some public and private companies may choose to adopt them voluntarily on account of investor or societal pressure.

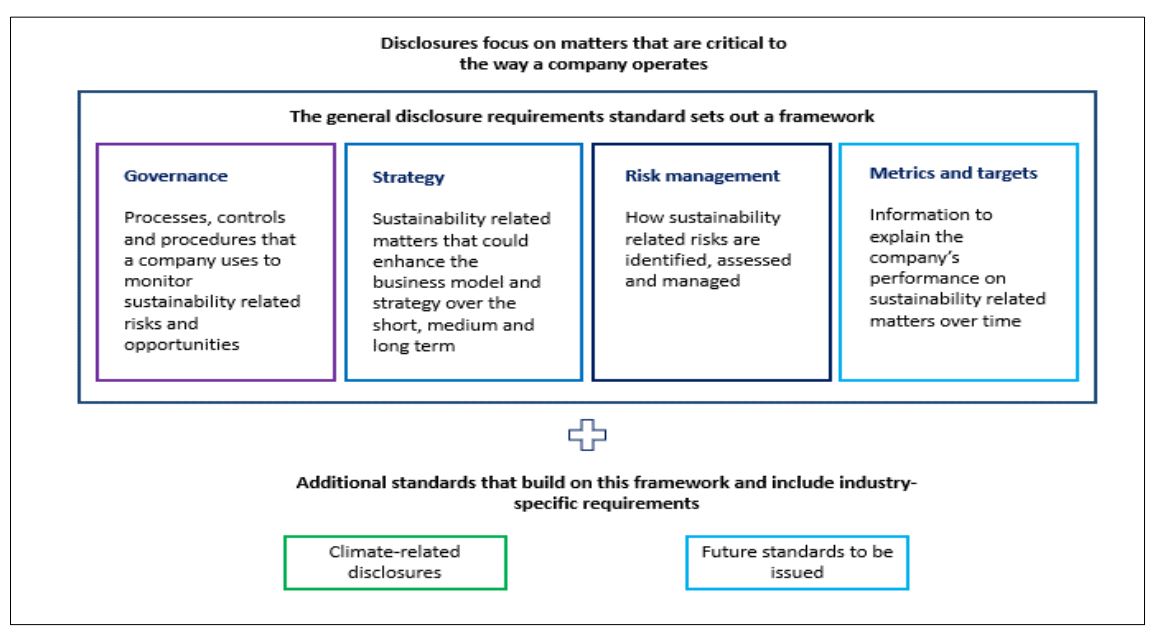

- Overview of the standards: The standards are designed to be applied together and are complementary in nature. IFRS S1 provides a framework for companies to report on all relevant sustainability-related topics across the areas of governance, strategy, risk management, and metrics and targets and provides guidance on general reporting aspects such as materiality, connected information, reporting boundary, fair presentation, etc. It is supported by more detailed guidance on how to report on climate-related risks and opportunities by IFRS S2.

(Source: Foundation for Audit Quality’s analysis, 2023 read with IFRS S1 and IFRS S2)

- Consistency with the existing frameworks: The standards have not been developed by the ISSB from scratch, but are based on the existing frameworks and standards, including the Task Force on Climate-Related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB). The ISSB is also committed to working with the Global Reporting Initiative (GRI) to ensure that the standards are complementary to and compatible with the existing GRI standards. Additionally, ISSB has also been working closely with the jurisdictional standard setters and incoming mandatory reporting frameworks – for example, the European Commission and the European Financial Reporting Advisory Group (EFRAG) in the EU, and the Securities and Exchange Commission (SEC) in the US.

- Interlinking sustainability and financial reporting: The standards refer to the information disclosed by companies as ‘sustainability-related financial disclosures’ – thereby implying that the sustainability-related and non-financial disclosures must be connected with the information in the financial statements and should thus, not be a separate exercise. Although, it may differ in nature from the information presented in the financial statements, the same needs to be consistent to the extent possible. This is required irrespective of whether the financial statements are prepared under IFRS Accounting Standards (AS) or other Generally Accepted Accounting Principles (GAAP).

To access the text of IFRS S1, please click here

To access the text of IFRS S2, please click here

Action Points for Auditors

- Since sustainability reporting is currently at a nascent stage worldwide, companies would need the necessary processes and controls in place to provide sustainability-related information of the same quality, and at the same time, as the financial statements.

- Currently, top 1,000 listed companies in India are required to furnish a Business Responsibility and Sustainability Reporting (BRSR) to the stock exchanges as a part of their annual report. As per the BRSR guidance note, listed companies could prepare and disclose sustainability reports (as part of annual report) based on internationally accepted reporting framework such as GRI, SASB, TCFD, Integrated Reporting (<IR>) and cross-refer the disclosures made under such frameworks to the disclosures sought under the BRSR. The mandatory reporting under BRSR does not restrict companies from adopting the ISSB framework and thus, companies may look to adopt these standards on a voluntary basis.

- ISSB has also released a consolidated industry-based guidance along with IFRS S2. It contains an exhaustive list of metrics/parameters which companies operating in different industries should report on while preparing their respective sustainability disclosures. Thus, the members should get an understanding of the same and discuss them with the management for developing necessary controls and processes to provide sustainability-related information.

Our Insights

Tools and Enablers

- Standard workpapers

- Technology tools

Resources

- Regulatory updates

-

India updates

Accounting updates

Auditing updates

Regulatory updates

-

International updates

Accounting updates

Auditing updates

Regulatory updates

-

Recap on key updates

-

Publications

India Publications

International Publications

-

Matter for auditors’ attention

-

Discussion/Consultation papers and Publications issued by regulators

India Publication

International Publication

Exposure Drafts/consultation papers

EDs/consultation papers

Matters for Consultation